Federal Tax Credits and State Rebates

Stack and combine other rebates and tax credits with your SVCE rebates to help you go all-electric at home and on the road.

Maximize Your Savings

Go all-electric at home and on the road more affordably by combining SVCE rebates with other available rebates and tax credits.

July 2025 Update: The One Big Beautiful Bill Act was signed into law on July 4, 2025, resulting in tax credits phasing out early, as follows:

- Electric Vehicle Tax Credits expire on September 30, 2025. EVs must be purchased by that date to qualify.

-

Heat Pump, Electric Panel, and Insulation Federal Tax Credits expire on December 31, 2025 (HEEHRA and HOMES credits will remain available). Installations must be completed by that date to qualify.

-

Solar + Battery Storage Tax Credits expire on December 31, 2025. Expenditures must be made before that date to qualify.

-

Despite the changes to federal tax credits, SVCE rebates and services will remain available and can be combined with other incentives. Explore below how to maximize your savings by stacking SVCE incentives with tax credits.

- Rebates often require reservations and permits – Most rebate programs require you to reserve your rebate before you make your appliance upgrade. In addition, most programs also require you to apply for the requisite permits from the city or county in which you live and to provide proof of permit application to claim the rebate.

- Combined rebates and tax credits cannot exceed total project costs – Your rebate amount will be adjusted if your project cost is less than the rebate.

- Be sure your project meets all requirements to be eligible for all programs – Rebate programs may have different rules, including the ability to stack with other programs, equipment eligibility, contractor requirements, and rebate applications.

- Confirm rebate amounts and availability with the appropriate program administrator – The information in the image and table below reflects rebate programs as of the date listed above the table and may not be fully exhaustive. Rebate amounts and availability are subject to change at any time by the program administrator.

- The tax credit information on this webpage is for informational purposes only – It is not intended to be a substitute for expert advice from a professional tax or financial planner or the Internal Revenue Service (IRS). Learn more about federal tax credits and consult a professional tax advisor on how to claim them.

- Rebates often require reservations and permits – Most rebate programs require you to reserve your rebate before you make your appliance upgrade. In addition, most programs also require you to apply for the requisite permits from the city or county in which you live and to provide proof of permit application to claim the rebate.

- Combined rebates and tax credits cannot exceed total project costs – Your rebate amount will be adjusted if your project cost is less than the rebate.

- Be sure your project meets all requirements to be eligible for all programs – Rebate programs may have different rules, including the ability to stack with other programs, equipment eligibility, contractor requirements, and rebate applications.

- Confirm rebate amounts and availability with the appropriate program administrator – The information in the image and table below reflects rebate programs as of the date listed above the table and may not be fully exhaustive. Rebate amounts and availability are subject to change at any time by the program administrator.

- The tax credit information on this webpage is for informational purposes only – It is not intended to be a substitute for expert advice from a professional tax or financial planner or the Internal Revenue Service (IRS). Learn more about federal tax credits and consult a professional tax advisor on how to claim them.

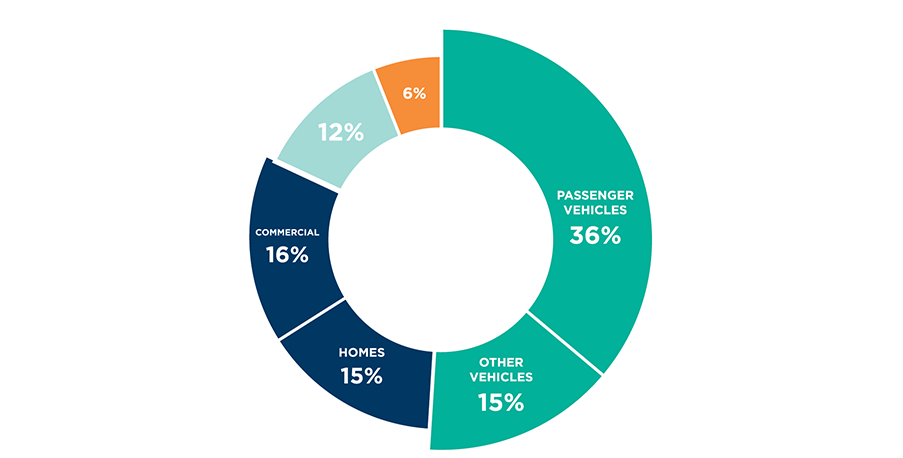

Hover over the pulsing dots within the home below to explore the rebates and credits available for each technology.

Other rebates available as of December 2025.

| Technology | SVCE Rebates1 | Federal Tax Credit | Statewide Rebates | ||||

|---|---|---|---|---|---|---|---|

| IRA (HEEHRA) Rebates5 | IRA (HOMES) Rebates | Golden State Rebates | TECH Clean CA | California Energy Smart Homes | |||

| Heat Pump Water Heater | $2,0002 | 30% of total cost after rebates (up to $2000)7 | Coming soon | Coming soon | Up to $9008 | Up to $1,8002&6 | $4,250 for whole-home electrification |

| Heat Pump Space Heating and Cooling | $2,5002 | 30% of total cost after rebates (up to $2000)7 | Up to $8,0004 | Coming soon | N/A | Up to $1,5002&3 | |

| Induction Cooktop | $5002 | N/A | Coming soon | Coming soon | N/A | N/A | |

| Gas Meter Removal | $500 | N/A | N/A | Coming soon | N/A | N/A | |

| Heat Pump Dryer | N/A | N/A | Coming soon | Coming soon | N/A | N/A | $250 bonus |

| Electrical Wiring | Up to $2,0002 | N/A | Coming soon | Coming soon | N/A | N/A | $1000 bonus |

| Electric Panel | $1,0002 | 30% of total cost after rebates (up to $600)7 | Coming soon | Coming soon | N/A | ||

| Insulation | N/A | 30% of total cost after rebates (up to $1,200)7 | N/A | Coming soon | N/A | N/A | N/A |

| Rooftop Solar | N/A | 30% of total cost7 | N/A | N/A | N/A | N/A | N/A |

| Battery Storage | N/A | 30% of total cost7 | N/A | N/A | N/A | N/A | N/A |

| EV Charger | N/A | 30% of total cost (up to $1,000)7 | N/A | N/A | N/A | N/A | N/A |

1Take advantage of SVCE Rebates via three incentive pathways. Learn more at Home Upgrades.

2Additional incentives available for income-qualified customers.

3 As of November 14 2025, TECH Clean CA rebates for HP HVAC are fully reserved. Additional funding may become available later. Please check with the program administrator.

4As of November 25, 2025, HEEHRA rebates for Heat Pump HVAC are open.

5Income limits apply.

6As of November 14 2025, TECH Clean CA rebates for HPWH are fully reserved. Additional funding may become available later. Please check with the program administrator.

7The One Big Beautiful Bill Act was signed into law on July 4, 2025, phasing out federal tax credits in 2025. EV tax credits will end on September 30, 2025. Heat Pump, Electric Panel, Insulation, and Solar + Storage tax credits will end on December 31, 2025. EV Charging tax credits end June 30, 2026 and are only available to residents located in eligible census tracts.

8As of November 12, 2025, Golden State Rebates for HPWH are open.

Other rebates available as of July 2025.

| Technology | SVCE Rebates | Federal Tax Credit | Clean Cars for All | PG&E Rebates |

|---|---|---|---|---|

| New Electric Car | Up to $20005 | Up to $12,0005 | N/A | |

| Used Electric Car | Up to $20005 | Up to $12,0005 | Up to $4,0005 |

5Income limits apply

7The One Big Beautiful Bill Act was signed into law on July 4, 2025, phasing out federal tax credits in 2025. EV tax credits will end on September 30, 2025.

Need Advice?

Go Electric Advisor is a free live service that helps SVCE customers take the guesswork out of going electric. Our team of friendly, trained professionals are here to help – from simple questions on incentives or appliances, to detailed custom go electric plans. Connect with us via live chat or email at goelectric.svcleanenergy.org or give us a call at 833-243-4235.

Frequently Asked Questions

Which rebates can I stack?

Generally, rebates are stackable as long as they come from separate funding sources. The following programs do not stack for the same technology, meaning you must select between either program:

- Golden State Rebates and California Energy Smart Homes cannot be stacked together

- IRA HEEHRA and IRA HOMES cannot be stacked together

Please consult with the program administrator for additional rules and eligibility.

How can the Inflation Reduction Act help me go all-electric at home and on the road?

The Inflation Reduction Act (IRA) is a federal bill that includes $370 billion in clean energy initiatives, including tax credits for electric vehicles and renewable energy sources. Part of this funding is going directly to help residents go all-electric at home and on the road.

The IRA includes both federal tax credits and state-administered rebates for efficient electric appliance upgrades (HEEHRA and HOMES).

- Federal Tax Credits for Home Improvement have criteria and annual limits for certain technology. Use the U.S. Department of Energy’s Tax Credit Product Lookup Tool to confirm that your appliance meets the tax credit criteria.

- The HEEHRA Rebate program (now available) provides point-of-sale rebates to help low-income and moderate-income households (up to 150% of area median income) go electric. Rebate amounts depend on income levels and technology.

- The HOMES Rebate Program (coming soon) is focused on energy efficiency, with rebates ranging from $2,000 to $4,000 in total. Rebate amounts will vary for individual households based on income level and the amount of energy usage reduced with the home upgrades.

It is important to note that the HEEHRA and HOMES rebate programs cannot be stacked together. For households who qualify for both, the HEEHRA rebates will generally be more financially beneficial.

The IRA also includes federal tax credits for new and used electric vehicles. Search for eligible vehicles using the U.S. Department of Energy’s tool.

June 2025 Update: Federal tax credits for clean energy upgrades may expire at the end of 2025 (federal policy changes are being debated now in the Senate; we will do our best to keep our customers informed of final decisions). Despite the potential changes to federal tax credits, SVCE rebates and services will remain available and can be combined with other incentives.

Why are some Inflation Reduction Act rebates not available right now?

The Inflation Reduction Act (IRA) is a 10-year plan, and the rebate programs and tax credits are scheduled to roll out throughout the upcoming years. As noted above, some IRA rebates are available now, with many more coming soon. You can also check the California Energy Commission, the state administrator for IRA rebates, for more information.

Will federal policy changes affect the Inflation Reduction Act, specifically the rebates for heat pumps, solar and battery tax credits, EVs, etc.?

Federal policy discussions may lead to thousands of dollars in federal tax credits for clean energy upgrades to sunset at the end of 2025. This could include tax credits for heat pumps, energy efficiency, EVs, and solar and battery. The One Big Beautiful Bill Act has been passed by the House of Representatives but is still being debated in the Senate, which may make further changes to the proposal.

Despite potential changes to the federal tax credits, SVCE rebates and services will remain available and can be combined with other incentives. SVCE’s reserves and finances remain strong, and the SVCE Board is committed to providing robust programs for our customers, including whole-home electrification support, multi-family EV charging, and income-qualified EV rebates.

When would the potential sunset of federal tax credits for heat pumps, EVs, solar and battery take effect?

The One Big Beautiful Bill Act is being debated in the Senate and changes to the tax credits are still to be finalized. Currently, tax credits can be claimed for the year in which the upgrades are made. Given that tax credits may expire by the end of 2025, upgrades will need to be made before the end of the year to be eligible for tax credits.

Do federal executive orders affect SVCE rebates and programs?

No – SVCE program funds are not tied to federal allocations.

Home Rebates & Tax Credits

- Switch is On: Use the incentive finder to discover other rebates and incentives

- Rewiring America: Check out their IRA Guide.

- Zero Energy Ready Home Guidance: New IRA tax credits provide new construction (or gutted & remodeled) residential buildings with $1000-$5000/unit for Zero Energy Ready Home (ZEHR) Certification.

- California Energy Commission FAQ: Answers to frequently asked questions for residents and contractors interested in state-administered IRA rebates.

Electric Vehicle Incentives

- EV Finder: Customize available federal, state and local incentives based on your income and cars of interest. Also, find a list of eligible rebates all in one place.

- Plug-in America: Additional information on EV incentives.

- Access Clean California: A public service program that helps people with low- to moderate-income find and apply for all of the energy assistance programs they may qualify for.

- Ride and Drive Clean Bay Area: Offers discounts on the MSRP of specific qualifying models.